Offering great benefits is just the starting point for employers. When your team understands their value, uses them purposefully, and sees how they support their growth and well-being, that’s when your benefits investment becomes a powerful tool for engagement, retention, and attracting top talent.

Offering great benefits is just the starting point for employers. When your team understands their value, uses them purposefully, and sees how they support their growth and well-being, that’s when your benefits investment becomes a powerful tool for engagement, retention, and attracting top talent.In this article, we explain why Q4 is the perfect time for your employees to review their benefits – and ensure they’re set up for success in the new year.

Simple Tweaks to your 401(k), HSA, and FSA Now Can Make an Impact in the Year Ahead

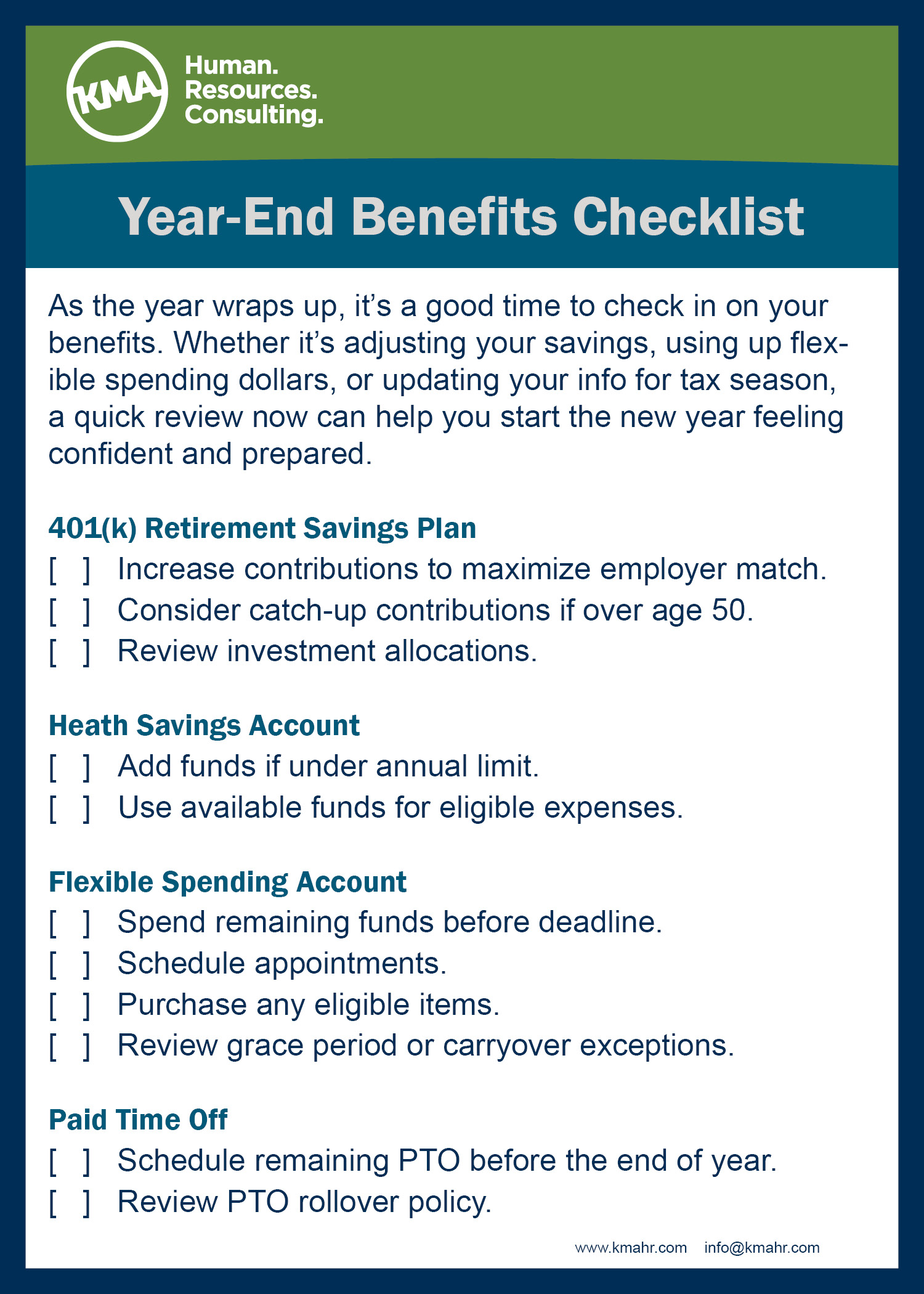

As the year winds down, it’s easy to get caught up in holiday plans and project deadlines, but don’t forget about your benefits. This is a great time to check in on your 401(k), HSA, and FSA contributions and make a few smart adjustments that could set you up for a stronger financial start in the new year. Whether it’s maximizing your retirement savings, using up flexible spending dollars, or simply updating your info for tax season, these small moves can make a big impact. We’ve put together a quick checklist to help you and your team stay on track.

401(k) Adjustments

- Increase contributions to take full advantage of employer matching or to reduce taxable income before year-end.

- Max out contributions if financially possible (the IRS sets annual limits).

- Review investment allocations to ensure they align with long-term goals and risk tolerance.

- Catch-up contributions for employees age 50+ who may want to contribute more.

HSA (Health Savings Account) Tweaks

- Add more funds if under the annual limit, especially if anticipating medical expenses.

- Use available funds for eligible expenses before the end of the year (though HSA funds roll over, it’s smart to plan).

- Check for employer contributions and make sure they’ve been received.

FSA (Flexible Spending Account) Reminders

- Spend remaining funds – most FSAs are “use it or lose it,” so any unused money may be forfeited.

- Schedule appointments or purchase eligible items, like glasses or prescriptions, before the deadline.

- Check for grace periods or carryover options. Some plans allow limited carryover into the next year.

Download KMA’s Year-End Benefits Checklist and share with your employees.

Need help communicating your benefits package to your employees, or reviewing your company’s benefits strategy before year-end? Reach out to the experts at KMA today.